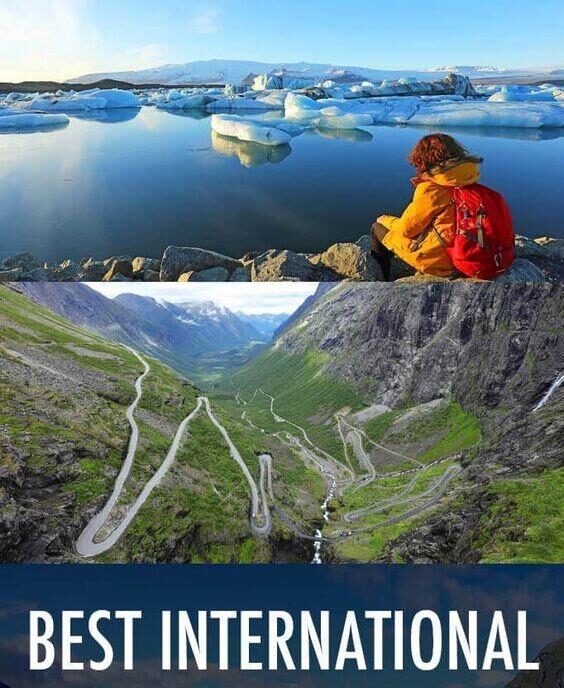

Are you planning an international adventure, be it a dream vacation, a business trip, or an academic pursuit? While exploring new horizons is exhilarating, it’s essential to ensure that you’re adequately protected with international insurance. In this comprehensive guide, we’ll unravel the intricacies of international insurance, helping you understand what it is, why you need it, and how to choose the right coverage for your global journeys.

Introduction: The Essence of International Insurance

Picture this: you’re strolling through the vibrant streets of Paris, savouring exquisite pastries and soaking in the Eiffel Tower’s beauty. Or perhaps you’re in bustling Tokyo, sampling sushi at a local izakaya. In the midst of these incredible experiences, the last thing you want to worry about is an unforeseen medical emergency, travel disruption, or lost luggage. That’s where international insurance comes to the rescue.

In this guide, we’ll explore the world of international insurance, addressing the fundamental questions and considerations that every traveler should be aware of.

What is International Insurance?

International insurance, often referred to as travel insurance or global insurance, is a specialized form of coverage designed to protect you during international trips. It serves as a safety net, ensuring you’re financially and medically protected when travelling abroad. International insurance typically covers a range of situations, including medical emergencies, trip cancellations, lost baggage, and more.

Why You Need International Insurance

1. Medical Emergencies

While abroad, you’re not always familiar with the local healthcare system or the costs associated with medical treatment. International insurance provides coverage for unexpected illnesses, injuries, and hospitalizations, offering peace of mind that you’ll receive proper care without astronomical bills.

2. Trip Cancellations

Life is unpredictable, and circumstances can force you to cancel or cut short your trip. International insurance often includes trip cancellation coverage, allowing you to recoup non-refundable expenses like flights and accommodations.

3. Travel Disruptions

Flight delays, missed connections, and other travel disruptions can turn your adventure into a nightmare. International insurance can provide compensation for these inconveniences, helping you stay on track.

4. Lost or Delayed Luggage

Imagine arriving at your destination only to find that your luggage is lost or delayed. International insurance can cover the cost of essential items you need while waiting for your bags to catch up with you.

5. Personal Liability

Accidents can happen, and you may find yourself liable for damages to others. International insurance often includes personal liability coverage, protecting you from legal expenses in such situations.

Comparing International Insurance Options

To help you make an informed decision, let’s compare our recommended international insurance plan with three competitors: Globetrotter Insurance, WorldwideGuard, and GlobalSafe Coverage.

1. Recommended: WorldProtector

Key Features:

- Comprehensive coverage for medical emergencies.

- Flexible policy durations to match your trip.

- High coverage limits for medical expenses.

- Trip cancellation and interruption coverage.

- Coverage for lost or delayed baggage.

- Personal liability protection.

- 24/7 customer support with multilingual assistance.

Competitor 1: Globetrotter Insurance

Key Features:

- Provides basic coverage for medical emergencies.

- Limited flexibility in policy durations.

- Lower coverage limits for medical expenses.

- Trip cancellation and interruption coverage with restrictions.

- Minimal coverage for lost or delayed baggage.

- Limited personal liability protection.

- Customer support may not be available 24/7.

Competitor 2: WorldwideGuard

Key Features:

- Offers decent coverage for medical emergencies.

- Limited choice in policy durations.

- Moderate coverage limits for medical expenses.

- Trip cancellation and interruption coverage with certain conditions.

- Coverage for lost or delayed baggage with restrictions.

- Personal liability protection is available but with limitations.

- Customer support is available during business hours only.

Competitor 3: GlobalSafe Coverage

Key Features:

- Budget-friendly coverage for medical emergencies.

- Short-term policy options.

- Lower coverage limits for medical expenses.

- Limited trip cancellation and interruption coverage.

- Basic coverage for lost or delayed baggage.

- Personal liability protection with certain restrictions.

- Customer support may not be as responsive.

Why WorldProtector Stands Out

WorldProtector is our top recommendation due to its comprehensive coverage, flexible policy durations, high coverage limits, and robust support services. Unlike competitors, WorldProtector ensures you have access to 24/7 customer support and multilingual assistance, making it a reliable choice for international travellers.

Additional Considerations

When selecting international insurance, keep the following factors in mind:

1. Policy Duration

Choose a policy duration that aligns with the length of your trip, including any potential extensions.

2. Coverage Limits

Ensure that the policy’s coverage limits adequately match the potential costs of healthcare and other expenses in your destination country.

3. Pre-Existing Conditions

If you have pre-existing medical conditions, confirm that the policy covers them or offers a waiver.

4. Deductibles

Understand the deductibles, which represent the out-of-pocket expenses you must pay before insurance coverage applies.

5. Travel Activities

Consider the activities you plan to engage in during your trip. Some adventurous pursuits may require additional coverage.

Conclusion

International insurance is your companion on global adventures, offering protection, peace of mind, and financial security. With WorldProtector, your journeys become carefree, and your memories remain undisturbed by unforeseen circumstances.

So, as you embark on your next international voyage, remember that you’re not just travelling; you’re travelling smart and safely. Here’s to your health and your unforgettable experiences! Safe travels!